Customer churn rate is one of the biggest risks to sustainable B2B growth. You can acquire new users every day, but if existing ones quietly leave, your revenue graph will flatten – and eventually decline.

Studies show that a 5% increase in customer retention can boost profits by 25% to 95%, while the average SaaS company loses between 5% and 10% of its customers every year.

Churn doesn’t just represent lost revenue. It’s lost potential, wasted acquisition costs, and missed referrals. Every canceled account is a signal that something in the customer journey failed: onboarding, value realization, support, pricing, or engagement.

This churn reduction guide explains how to measure churn rate, predict churn risk, and build an actionable plan to improve customer retention.

You’ll learn how to calculate churn rate, analyze why customers leave, and use predictive automation to retain more customers at scale.

Whether you’re running a SaaS startup or managing enterprise accounts, you’ll walk away knowing exactly how to turn retention into your most powerful growth strategy.

What is churn (and why it matters in B2B)

Customer churn rate simply means losing customers or revenue over time. In business terms, it’s the percentage of customers who stop using your product or service during a specific period.

For example, if you have 500 new customers in the first quarter and 450 of them remain in the next one, your churn rate over the quarter is 10%.

Churn rate and retention rate: Two sides of the same coin

Churn rates and retention rates are opposites. Churn refers to the customers lost over a period, while retention indicates the customers you keep.

If your retention rate is 75%, the churn rate is 25% and vice versa.

Churn in SaaS vs. other businesses

Churn is an inevitable part of every business. Whether you’re a street-side ice cream vendor or a global organization like Google or Microsoft, you’ll gain some customers and lose some.

However, traditional businesses that earn money through one-time transactions aren’t as adversely affected by churn.

However, it has a significantly deeper impact on businesses that rely on the subscription model for recurring revenue. A customer churn-out could lead to a loss of 12 or 24 months’ potential revenue.

SaaS providers are the primary adopters of this model, and hence, they’re most prone to the negative impacts of churn. In B2B SaaS, customer churn rate directly affects recurring revenue, LTV, and overall business predictability.

Let’s break down the different types of churn that impact your customer retention.

- Customer churn: Number of customers lost during a period.

- Revenue churn: Total recurring revenue lost from downgrades or cancellations.

- Voluntary churn: When customers actively choose to leave (e.g., poor experience, pricing issues).

- Involuntary churn: When customers leave unintentionally due to billing failures, expired cards, or process issues.

Why churn matters for growth

Even small churn percentages can cripple growth. Losing just 3% of customers every month adds up to 30% a year.

As churn increases, you spend more to acquire new customers just to maintain revenue.

Churn lowers customer lifetime value (CLTV), which limits how much you can invest in marketing and acquisition. It also creates constant pressure on sales and product teams to replace lost revenue.

In B2B SaaS, reducing churn isn’t just about retention but survival. A stable customer base compounds over time, while high churn drains your pipeline and profits.

How to calculate churn rate?

In this section, we’ll touch upon the formulas of customer and revenue churn. In addition, we’ll discuss cohort and snapshot analysis for churn calculation and some common mistakes to avoid while calculating churn.

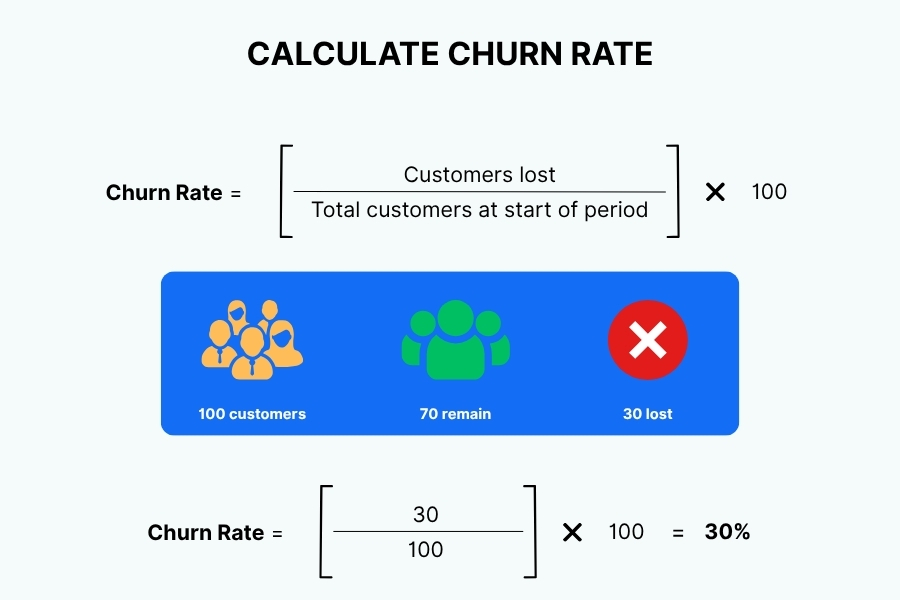

Customer churn formula

Here’s the churn rate formula:

Churn Rate = (Customers Lost ÷ Customers at Start of Period) x 100

Let’s understand this with another quick example.

Assume that you’re a SaaS provider offering a task management solution. In January, you had 100 paid consumers on a monthly plan. In February’s billing cycle, the paid customer count dropped to 80.

The remaining 20 were lost customers, or as we’ll now call them, churned customers.

As per the formula, the churn rate would be:

(20 ÷ 100) x 100 = 20%

Revenue churn formula

Similarly, you can calculate revenue churn using the following formula:

Revenue Churn Rate = (MRR Lost from Cancelations or Downgrades ÷ MRR at Start Period) x 100

Let’s go back to the previous example. Let’s say the 100 customers you had in January each were on a monthly plan of $10. Hence, the MRR here would be $10 x 100 = $1,000.

In the next month’s billing cycle, 20 customers churned out, reducing the MRR by $10 x 20 = $200.

Hence, the revenue churn would be:

(200 ÷ 1000) x 100 = 20%

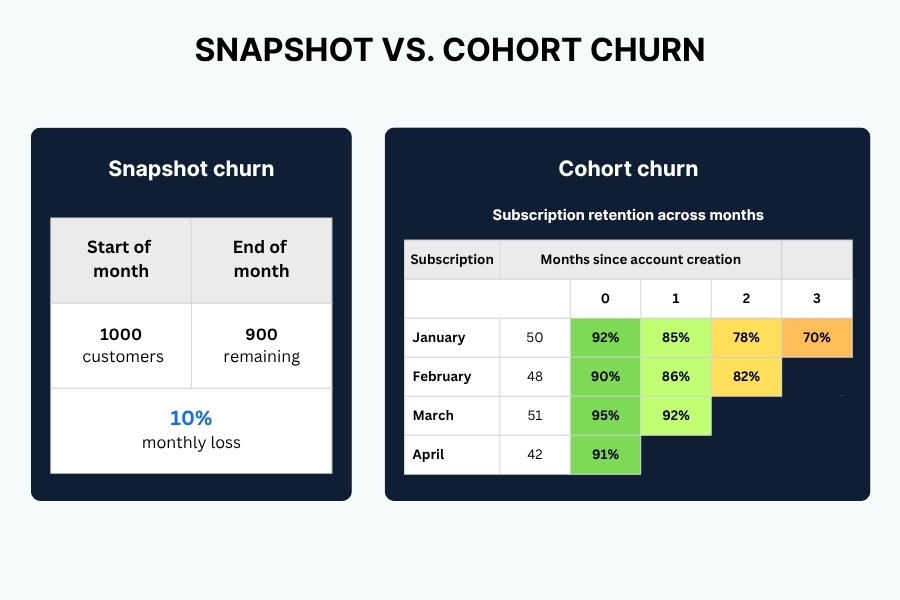

Snapshot vs. Cohort churn analysis

Snapshot analysis is a broader, more straightforward method of calculating churn where you take a “snapshot” of all active customers at the start of a specific period and see how many of them have been lost (or churned).

All the examples we’ve seen so far have been of snapshot churn analysis. While it’s effective for quick KPI reporting and getting a full high-level view of churn trends, it misses the nitty-gritty details.

That’s where cohort churn analysis comes in.

As the name suggests, in cohort churn analysis, customers are divided into a cohort – a group of people sharing a common trait. It could be the signup month, acquisition source, active plan, location, and so on.

Instead of analyzing all customers as a single group, this method segregates them into cohorts and evaluates them separately.

This method helps you discover hidden retention and churn patterns, enabling you to make better-informed decisions.

In the previous example, we discussed that there were 100 active customers in January and 80 in February, indicating a 20% churn.

Now, of those 100 active customers, 50 were onboarded in January itself. Let’s call it the January cohort.

Of those, only 25 renewed in the next month. Hence, the churn from January to February in the January cohort is 50%.

It indicates that customers onboarded in January have a higher churn rate than those onboarded earlier. This data helps you identify a trend and focus more on engaging the January cohort.

What is a good churn rate?

As discussed, churn is a part of every business, and you can’t totally eliminate it. Your aim should be to keep it under control so that it doesn’t adversely affect your business.

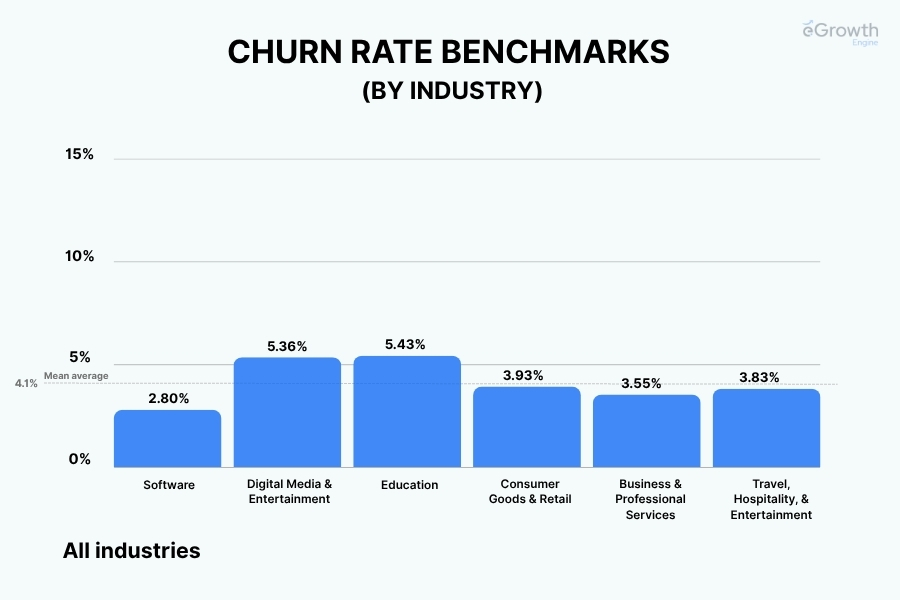

Let’s look at some churn rate benchmarks across industries to help you determine if your churn rate is healthy or needs fixing.

As you can see, B2B providers, including software (SaaS) and professional services, witness a lower churn rate than B2C/D2C providers.

However, since B2B companies rely more on recurring payments, customer churn is more likely to hit their bottom line.

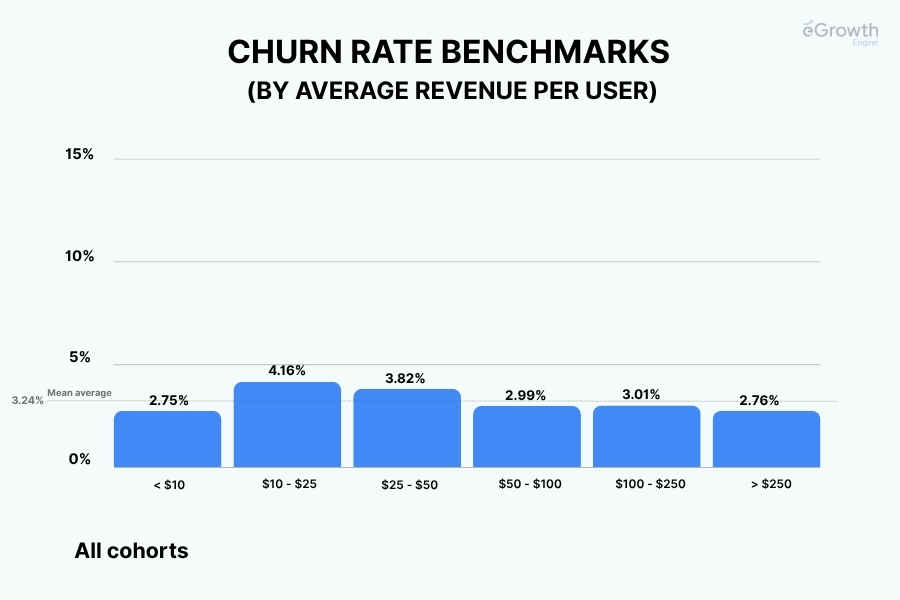

Churn rate can also vary by the average revenue per user or ARPU as shown below.

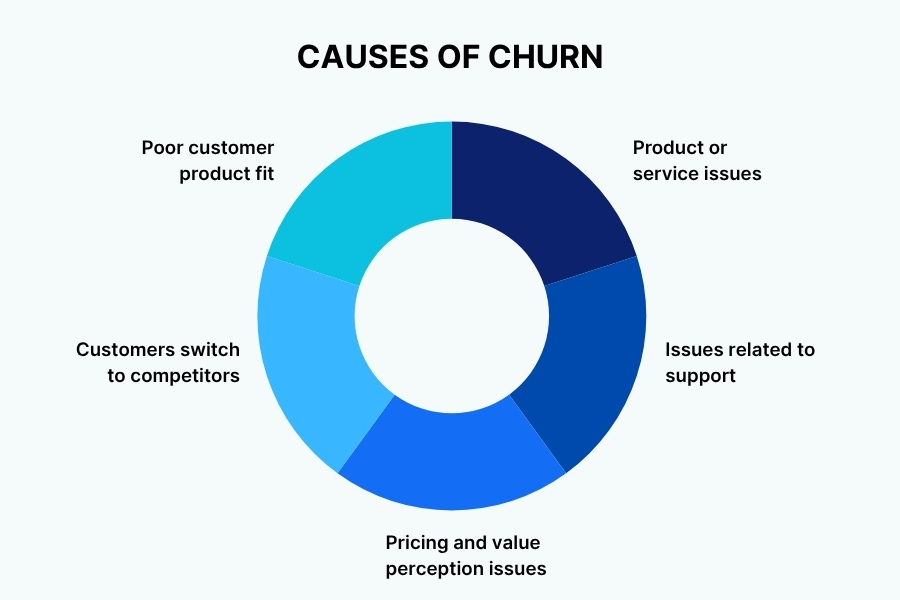

Why customers churn – The root causes

Understanding why customers leave is the first step to reducing churn. Most cancellations or drop-offs aren’t random — they’re driven by identifiable issues across product, service, pricing, or customer experience. When analyzed correctly, these patterns reveal exactly where you need to intervene.

Let’s look at some common reasons for customer churn.

1. Issues related to the product or service

It’s a no-brainer, right? If consumers fail to find value in your product or service, they won’t use it.

Now, this can stem from a variety of factors, like poor onboarding, missing features, usability challenges, recurring bugs, and pricing issues.

To fix it, you first need to have a valuable offering that truly helps your consumers. Then, price it competitively, make it easy to use, and streamline onboarding to help users realize value faster.

2. Issues related to support

Even if you have a top-notch product or a service that adds value, poor customer support will render all of it useless. Slow response times, unresolved issues, or a lack of proactive support can frustrate even satisfied users.

Poor support deteriorates customer experience and makes competitors look more appealing, resulting in churn.

To fix it, you need to amp up your customer support. Set clear service-level agreements (SLAs), offer multi-channel support through help documentation, in-app chat, email, and phone, and train your support team to prioritize user satisfaction.

3. Pricing and value perception issues

Perceived value is a huge driver of purchase decisions, especially in B2B and SaaS. Even if customers like your product, they may not see enough value for the price they pay, especially if competitors offer similar features for less.

To fix it, you need to reinforce value through ROI-driven communication. And if needed, reassess your pricing strategy and experiment with flexible plans.

4. Customers switch to competitors

Almost all SaaS markets are crowded, some more than others. If you’re in a sector that has a plethora of players, customers will have too many options to choose from, which makes switching more likely.

Even if your market isn’t crowded, the SaaS landscape evolves fast. If your product isn’t improving or differentiating itself while others are, customers may churn due to better alternatives.

To fix it, you need to monitor your competitive landscape and ensure you’re offering value to your customers that exceeds that of your competitors.

5. Poor customer fit

Sometimes, churn happens because customers were not the right fit for your product. You may have targeted an audience outside your ideal customer profile (ICP), or non-ICP consumers may have discovered you through organic channels.

It’s probable these consumers were encouraged by your marketing communications to try out your product, but after using it, they didn’t realize its value.

That doesn’t mean your product is faulty. It simply means the customers weren’t the right fit.

To fix this, refine your targeting and communication to attract consumers who’ll truly benefit from your solution.

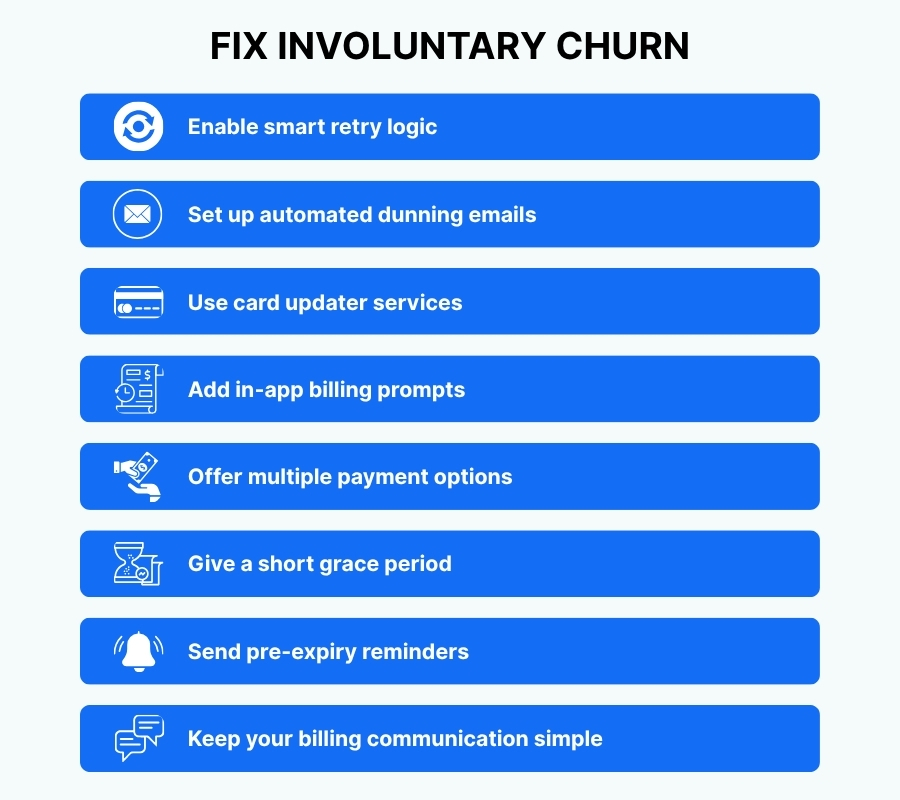

Involuntary churn: The silent parasite eating away at your revenue

Not every customer who churns does so intentionally. Involuntary churn happens when paying users are lost due to billing issues like expired cards, insufficient funds, or payment gateway errors. The frustrating part? These customers still want your product, but a failed transaction gets in the way.

In SaaS, 20–40% of total churn can come from failed payments. It’s one of the easiest types of churn to fix because it doesn’t require product or pricing changes — just better systems.

Here’s how to reduce involuntary churn:

1. Enable smart retry logic

Don’t stop at one failed attempt. Set automated retries spaced over several days or weeks. Smart retry systems increase the chances of recovering payments without needing manual follow-ups.

2. Set up automated dunning emails

Create a sequence of friendly payment reminders. For example, one immediately after failure, another after 3 days, and one final notice after 7-14 days. Keep the tone helpful, not alarming, and always include a one-click payment update link.

3. Use card updater services

Activate automatic card updater systems that refresh expired or reissued cards. This keeps billing data current without needing customer intervention.

4. Add in-app billing prompts

If a payment fails, show a simple notification or banner inside the product. Make it easy for users to update their details without leaving the app or navigating a complicated billing page.

5. Offer multiple payment options

Give users flexibility to pay via ACH, PayPal, or credit card. You can also let them add a backup payment method in case their primary one fails.

6. Give a short grace period

Don’t immediately cut off access after a failed payment. Offer a short grace period (for example, 5–7 days) to allow users to fix billing issues without disrupting their work.

7. Send pre-expiry reminders

Notify users when their card is about to expire, ideally 30 days and again 7 days before. Include the last four digits of the card for clarity and a direct link to update details.

8. Keep your billing communication simple

Make your dunning and renewal emails straightforward. Avoid jargon and long paragraphs. Clearly explain what happened, what action is needed, and make it one click to fix.

By optimizing your billing workflows, you can significantly reduce involuntary churn and recover lost revenue.

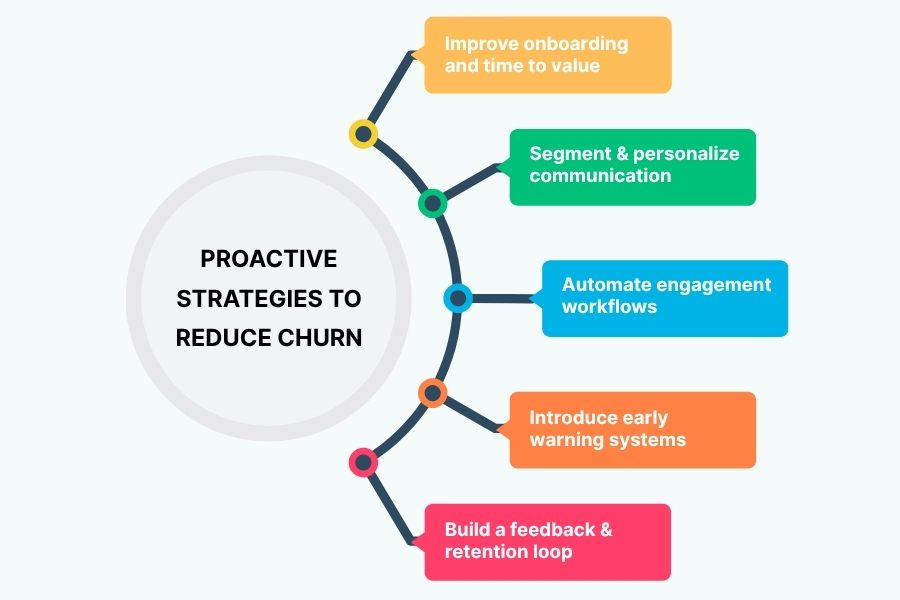

Proactive strategies to reduce churn

Now that we’ve ensured customers aren’t churning out involuntarily due to billing issues, let’s focus on real problems.

Here are some practical steps you can take to reduce churn.

1. Improve onboarding and time-to-value

Your onboarding process sets the tone for the entire customer journey. If users don’t see value fast, they won’t stay. Focus on helping them achieve their first meaningful outcome — their “aha moment” — as quickly as possible.

How to do it:

- Simplify onboarding flows and remove unnecessary steps

- Use in-app tours, videos, or checklists to guide new users

- Highlight quick wins in the first login session

- Assign success managers for high-value accounts

2. Segment and personalize communication

Not all customers churn for the same reason. Group users by size, behavior, or stage in their journey and tailor communication accordingly. Personalized, relevant messages build stronger relationships and improve retention.

How to do it:

- Segment users by engagement, activity level, and feature adoption.

- Send contextual emails — for example, “You’re 80% done setting up your workflow.”

- Use targeted product updates instead of generic newsletters.

3. Automate customer engagement workflows

Automation allows you to stay consistent without overwhelming your team. Trigger personalized interactions at key moments — like inactivity, milestone achievements, or approaching renewals.

How to do it:

- Set up behavioral triggers based on in-app actions.

- Automate check-ins for inactive users.

- Use email and in-app notifications to celebrate achievements or prompt the next action.

With eGrowthEngine, you can build engagement workflows that trigger automatically based on behavior, usage, or timing — keeping your customer relationships active without manual effort.

4. Introduce early warning systems

The earlier you spot a risk signal, the easier it is to intervene. Early warning systems use behavioral data to detect churn patterns before they turn into cancellations.

How to do it:

- Monitor product usage metrics such as login frequency or feature activity.

- Identify sudden drops in engagement or payment delays.

- Automate alerts for success or account teams when a customer’s health score declines.

5. Build a strong feedback and retention loop

Retention isn’t static — it improves when you continuously listen and act. Collect feedback regularly, identify recurring issues, and close the loop by communicating what you’ve improved.

How to do it:

- Send quarterly NPS or satisfaction surveys.

- Track feedback by segment to uncover systemic problems.

- Create customer advisory groups for direct input.

- Use feedback data to prioritize roadmap changes.

When done right, these proactive strategies build a system that keeps users engaged, satisfied, and loyal.

How to predict churn with data and automation

Churn prediction is about identifying warning signs before a customer leaves — not after. By tracking behavior patterns, usage data, and engagement signals, you can forecast which customers are likely to churn and take action early.

Modern SaaS and B2B businesses increasingly rely on automation and predictive analytics to identify at-risk accounts in real time.

Here’s how to build a data-driven churn prediction system:

1. Track the right leading indicators

Don’t wait until cancellations happen. Focus on early signs of disengagement that often appear weeks before churn.

Key indicators include:

- Drop in login frequency or active sessions.

- Reduced feature usage or skipped core workflows.

- Increase in support tickets or negative sentiment.

- Decline in account expansion or renewal engagement.

These signals can be collected from your CRM, product analytics, or marketing automation platform — and should form the foundation of your churn risk model.

2. Use churn prediction models

Advanced teams use predictive models to score customer churn risk automatically.

Examples include:

- Logistic regression: Uses historical churn data to predict probability based on key variables (like usage frequency, account age, etc.).

- Machine learning models: Train algorithms to detect complex patterns and predict churn more accurately over time.

- Health score models: Combine multiple weighted metrics (product usage, engagement, NPS) to assign a simple red–amber–green risk level.

Even without complex AI tools, you can still start simple — with weighted scoring that ranks customers based on their recent activity and satisfaction.

3. Build churn forecasting dashboards

Turn your data into action with a central dashboard that tracks churn indicators and overall account health.

Your dashboard should include:

- Current churn rate and predicted churn risk.

- Customer health scores by segment.

- Usage trends over time (logins, feature adoption).

- Retention and renewal forecasts.

This helps your success, product, and marketing teams stay aligned on which accounts need immediate attention.

4. Automate churn prevention actions

Prediction alone isn’t enough — you need to respond automatically when a customer shows signs of risk.

How to act on churn predictions:

- Trigger automated engagement workflows when health scores drop.

- Assign high-risk accounts to customer success managers.

- Send personalized re-engagement campaigns to low-usage users.

- Offer incentives like consultations, training sessions, or usage credits to win them back.

eGrowthEngine helps you do this seamlessly. It continuously monitors behavioral drop-offs, campaign engagement, and CRM data to score churn risk. When a risk signal appears, it automatically triggers re-engagement flows or alerts your team to act.

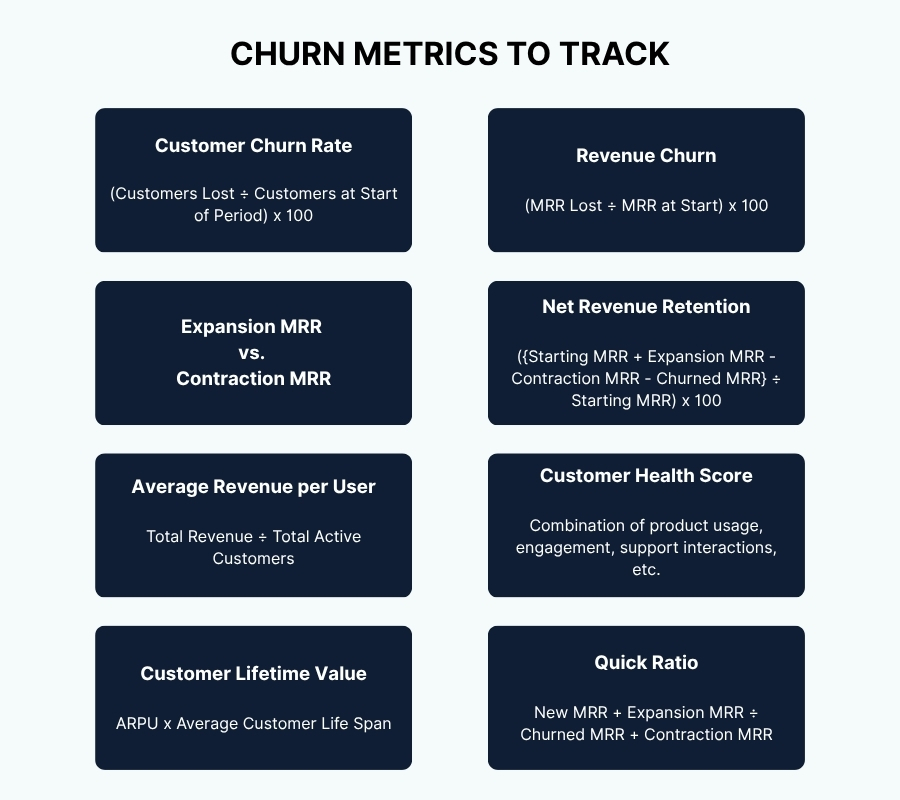

Churn analysis and metrics to track

You can’t improve what you don’t measure. Tracking churn and retention metrics gives you the visibility needed to understand where customers drop off and why. It also helps you identify which actions, segments, or campaigns contribute most to long-term retention.

Here are the key churn and retention metrics every B2B or SaaS company should track — along with how to calculate them:

1. Customer churn rate

What it measures: The percentage of customers lost during a specific period.

Formula:

Customer Churn Rate = (Customers Lost ÷ Customers at Start of Period) x 100

Example: If you start with 1,000 customers and lose 50 during the month, your churn rate is 5%.

This metric shows how well your business retains users over time. Lower is always better.

2. Revenue churn rate

What it measures: The percentage of monthly recurring revenue (MRR) lost due to downgrades or cancellations.

Formula:

Revenue Churn = (MRR Lost ÷ MRR at Start) x 100

Example: If you started the month with $100,000 MRR and lost $5,000, your revenue churn rate is 5%.

Revenue churn gives a more accurate view of financial health, especially for tiered or usage-based pricing models.

3. Expansion MRR vs. Contraction MRR

What it measures: The revenue gained from upsells and cross-sells versus revenue lost from downgrades.

Why it matters: A healthy SaaS business aims for negative churn, where expansion revenue outpaces lost revenue.

4. Net revenue retention (NRR)

What it measures: The percentage of recurring revenue retained from existing customers after accounting for churn and expansion.

Formula:

NRR = ({Starting MRR + Expansion MRR – Contraction MRR – Churned MRR} ÷ Starting MRR) x 100

Example: If you start with $100,000 MRR and end up with $110,000 after churn and expansion, your NRR is 110%.

Why it matters: NRR above 100% means your existing customers are growing in value — a key sign of product–market fit.

5. Average revenue per user (ARPU) trend

What it measures: The average amount of revenue generated per customer.

Formula:

ARPU = Total Revenue ÷ Total Active Customers

Tracking ARPU trends helps you identify whether you’re successfully moving customers toward higher-value plans.

6. Customer health score

What it measures: A composite metric combining product usage, engagement, support interactions, and satisfaction (NPS).

Why it matters: It provides a simple “green/yellow/red” snapshot of customer well-being and churn risk.

7. Customer lifetime value (CLTV)

What it measures: The total revenue a customer generates during their relationship with your company.

Formula:

CLTV = ARPU x Average Customer Life Span (months or years)

CLTV helps you decide how much to spend on acquisition and retention while staying profitable.

8. Quick ratio and payback period

Quick ratio: Measures how efficiently you grow revenue relative to churn.

Quick Ratio = New MRR + Expansion MRR ÷ Churned MRR + Contraction MRR

A quick ratio above 4 is considered excellent.

Payback period: The time it takes to recover your customer acquisition cost (CAC) through revenue.

Shorter payback periods indicate faster ROI and higher growth potential.

How eGrowthEngine helps reduce churn

Reducing churn isn’t just about reacting when customers leave; it’s about staying ahead of the curve. eGrowthEngine empowers SaaS and B2B teams to predict, prevent, and reduce churn through automation, personalization, and real-time insights.

Here’s how it helps you keep more customers, longer:

- Auto-identifies and segments at-risk customers based on engagement, usage, and revenue impact.

- Triggers behavior-based re-engagement with targeted emails, in-app messages, and workflows.

- Reduces involuntary churn through automated retries, billing reminders, and card updater tools.

- Accelerates onboarding and time-to-value with guided flows and milestone tracking.

- Detects upsell and retention opportunities using activity-based intent signals.

- Centralizes churn and retention analytics in a unified, real-time dashboard.

- Integrates seamlessly with your CRM and billing tools for complete data visibility.

Wrap up: How to reduce churn

Churn will always exist, but letting it control your growth is a choice. The most successful B2B and SaaS companies do not just react when customers leave; they predict risk early, engage proactively, and build systems that keep users satisfied and invested.

Reducing churn is not about luck or timing. It is about understanding behavior, acting on data, and delivering consistent value throughout the customer lifecycle. With eGrowthEngine, you can automate this entire process, from detecting early warning signs to launching re-engagement campaigns that work.

Start building stronger customer relationships today and turn retention into your most powerful growth strategy.

You may also like

Account-based Marketing Strategy: A Complete Guide to B2B Growth and Automation

Master your account based marketing strategy with this complete B2B guide. Learn how to identify high-value accounts, personalize campaigns, track key ABM metrics, and use eGrowthEngine to automate and scale your results for maximum ROI.

SaaS Marketing Guide: How to Convert Free Users into Paying Customers

In this guide, we’ll show you how to build high-converting free experiences, track the right signals, and create a scalable SaaS marketing process for conversion. Whether you’re offering a free trial or a freemium plan, this article will help you...

Benefits of Email Marketing: 12 Reasons Why Email Marketing Still Reigns

Whether you're a startup or a growing brand, email gives you a direct, personal line of communication with your customers. Let's look at the most important benefits of email marketing and why it should be a key part of your email marketing strategy.

Cold Email Outreach Strategy: How to Approach, Nurture, and Close Cold Leads

Learn how to write a cold email that get responses. This guide covers proven strategies to approach, nurture, and convert cold leads with effective outreach, smart sequencing, and automation tips for B2B success.